BNP Paribas Group: Results as at 31 December 2018

The Board of Directors of BNP Paribas met on 5 February 2019. The meeting was chaired by Jean Lemierre and the Board examined the Group’s results for the fourth quarter and endorsed the 2018 financial statements.

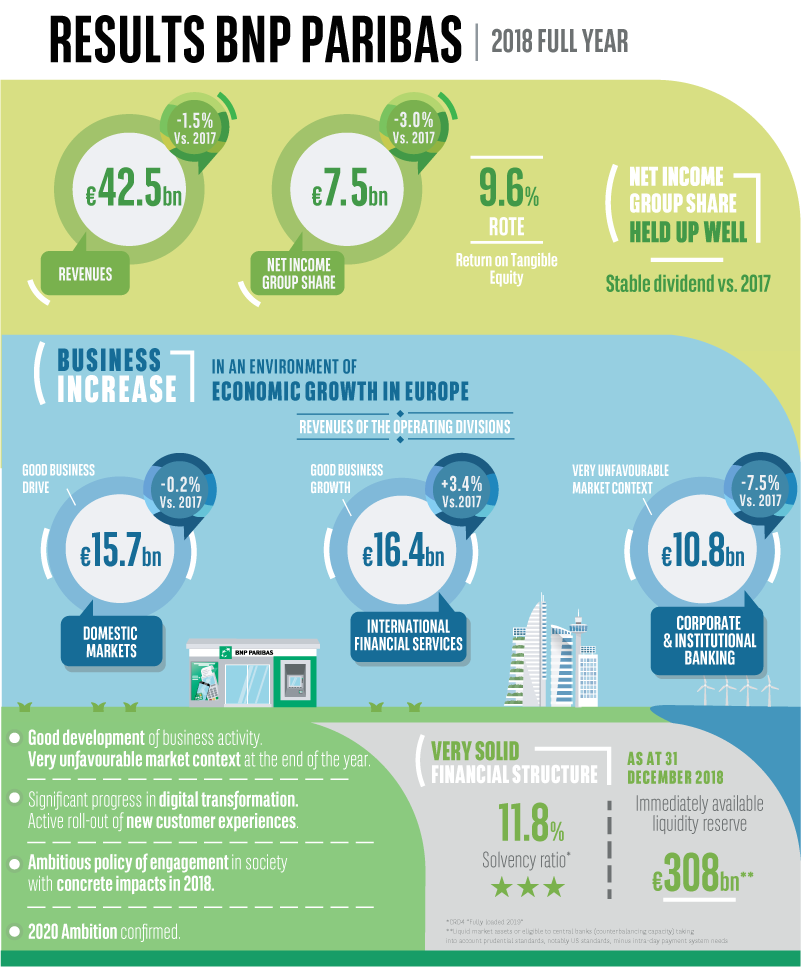

Group delivered in 2018 7.5 billion euros in net income.

BUSINESS INCREASE IN AN ENVIRONMENT OF ECONOMIC GROWTH IN EUROPE OUTSTANDING LOANS: +3.9% vs. 2017 |

REVENUES OF THE DIVISIONS HELD UP WELL DESPITE LOW RATES AND UNFAVOURABLE FINANCIAL MARKET CONTEXT, IN PARTICULAR AT THE END OF THE YEAR REVENUES OF THE OPERATING DIVISIONS: -0.4% vs. 2017 |

DEVELOPMENT OF THE SPECIALISED BUSINESSES OF DOMESTIC MARKETS AND INTERNATIONAL FINANCIAL SERVICES DECREASE OF COSTS IN THE RETAIL NETWORKS AND CIB OPERATING EXPENSES OF THE OPERATING DIVISIONS: +1.7% vs. 2017 |

DECREASE IN THE COST OF RISK -4.9% vs. 2017 (35 bp) |

NET INCOME GROUP SHARE HELD UP WELL NET INCOME GROUP SHARE: €7,526m (-3.0% vs. 2017) DIVIDEND PER SHARE €3.02 (stable vs. 2017) |

VERY SOLID BALANCE SHEET CET1 RATIO: 11.8% |

BUSINESS GROWTH SIGNIFICANT PROGRESS IN THE DIGITAL TRANSFORMATION |

Commenting on these results, Chief Executive Officer Jean-Laurent Bonnafé stated: “Thanks to its diversified and integrated model, the Group delivered in 2018 7.5 billion Euros in net income. The fully loaded Basel 3 common equity Tier 1 ratio is 11.8%, attesting the high robustness of the balance sheet. BNP Paribas’ digital transformation plan is being successfully implemented, illustrated by the roll out of numerous new customer experiences. The Group is actively executing its ambitious policy of engagement in society. The Group is committed to its 2020 ambition and implements further savings to significantly improve operating efficiency in all the operating divisions as early as 2019.”