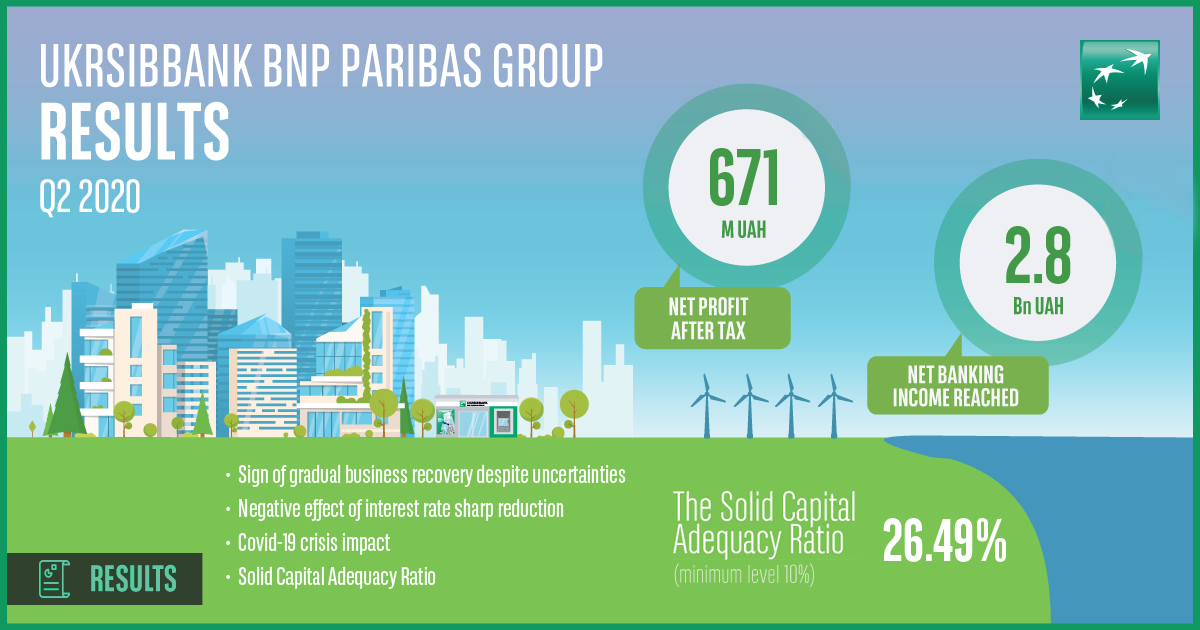

In 2Q’20 the UKRSIBBANK has posted NPAT (net profit after tax) of UAH 671M

Net banking income reached

2,8 Bn UAH

Q2 2019 to 6%

Q2 2020

The operational expenses reached 1.8Bn UAH (+7% YoY). The increase indicates the bank transformation commitments by investing in Human and IT capital despite the outbreak of Covid-19 and strong reduction of interest rates.

Cost of risk amounted -216M UAH due to negative base effect and impacted by Covid -19 in Q2 2020.

Solid Capital Adequacy Ratio of 26.49%, far above the minimum level of 10%, leaving room for further responsible growth.

In a context of a Covid-19 crisis that is both unique and violent UKRSIBBANK employees have been able to meet client needs swiftly and comprehensively.