UKRSIBBANK BNP PARIBAS GROUP financial results in 2016

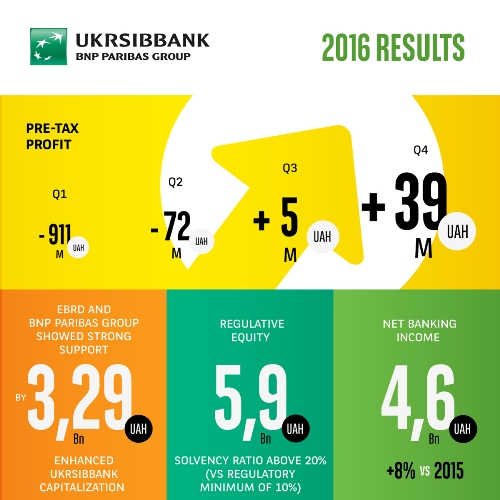

UKRSIBBANK BNP PARIBAS Group posted in the 4th Quarter 2016 a pre-tax profit of UAH 39 M.

Despite the sharp decrease in interest rates during 2016, UKRSIBBANK has maintained its quarterly net banking income at a strong level throughout the year. Thanks to a stringent cost management and a progressive decrease in cost of risk, the bank has posted a positive pre-tax profit of UAH 39 M in the last quarter of 2016.

On a full year basis, the net banking income reaches UAH 4.6 Bn (+8% vs 2015) while expenses are under control at UAH 2 Bn, increasing by 6% vs 2015, far below inflation. The strong gross operating income of UAH 2.6 Bn, in progress of +9% compared to 2015, is the result of the transformation of UKRSIBBANK started in 2014 with various cost optimization initiatives and finalized in 2016 a.o. with the restructuring of the equity.

Overall, all business lines contributed to the increase of the gross operating result up to UAH 2.6 Bn, with a cost/income ratio improving to an effective level of 43%.

After taking into account the cost of risk mainly driven by the legacy FX mortgage portfolio, the 2016 full year net result is UAH -994 M. After first 2 quarters of losses weighting heavily on the full year performance and a return to profitability in Q3, UKRSIBBANK has confirmed in Q4 its ability to post structurally a positive pre-tax profit.

Thanks to its very strong liquidity both in local and foreign currency, the Bank has continued in 2016 the development of its lending activities. It has diversified its customer base in Corporate, Agricultural sector & SME and increased its presence in personal finance market. The sound loan portfolio has grown by 20% in 2016. This growth in outstanding has been though offset by the important additional provisions related to the legacy FX mortgage portfolio. As a result, overall, the loan net outstanding remains stable compared to end 2015, at UAH 21 Bn.

UKRSIBBANK’s deposits grew year-on-year by 10% and reach UAH 36 Bn. The Bank has continued its strategy to increase its relatively cheap retail deposit base while decreasing progressively the expensive funding provided by corporate customers.

The Bank solvency has been strongly reinforced in 2016 with the conversion of subordinated debt (USD 130 M) into share capital. At the end of 2016, the regulatory equity of UAH 5.9 Bn leads to a solvency ratio in excess of 20%, well above the regulatory minimum of 10%. UkrSibbank is the second best capitalised bank among its peers.

“The bank has been successfully transformed, the customer base is sound and the liquidity is strong both in local and foreign currency. Our business model pays off.” — says Philippe Dumel, Chairman of the Management Board. — “In 2017, we will stick to our strategy and continue to provide our customers with best-in-class products & services and help them develop Ukrainian economy. I’m confident about the future and the ability of our bank to perform in 2017”.