UkrSibbank BNP Paribas Group posted at the end of 3rd Quarter 2017 a net result of UAH 856 M.

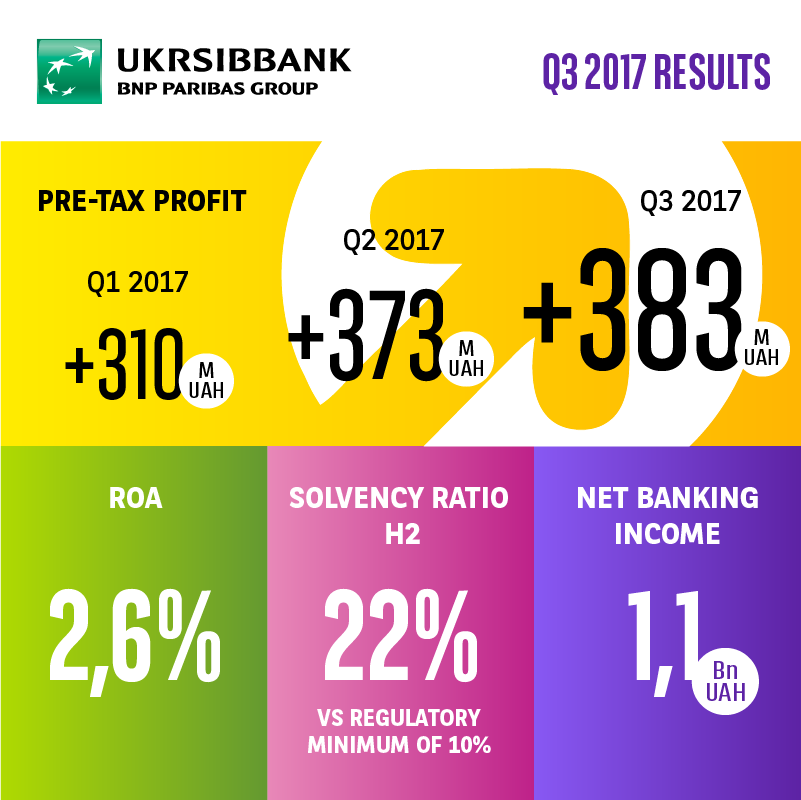

After an excellent bottom-line in the first two quarters of 2017, UkrSibbank has posted a record quarterly result before tax of UAH 383 M in Q3-17, bringing the cumulative net result at UAH 856 M. These strong results reflect the efficiency of the bank’s business model in the stabilized Ukrainian environment.

The bank has partially offset the negative impact of drop in interest rates and the narrowing of FX spreads in a normalizing environment, by diversifying its sources of revenues and continuing to invest in its core customer segments Corporate, Premium and Personal Finance. At the end of Q3-17, the NBI decreased by 10% compared to Q3-16, while the cost of risk decreased by 85% YoY.

The individual FX loan portfolio continued to shrink thanks to the various initiatives of conversion into local currency, performed at preferential conditions for the customers. These successful campaigns launched mid 2016 enabled the bank to reduce the remaining risks related to this legacy portfolio, hence the cost of risk dropped significantly in 2017.

In September, UkrSibbank has successfully launched its new internet & mobile platform for individuals, strengthening further its relationship with digital customers. It continued to develop its lending activities both to corporate and personal finance customers. The loan portfolio reached UAH 19.5 Bn, in growth of 5.9% compared to Q3-16. Customer deposits grew by 3.7% YoY to reach UAH 34.2 Bn, providing to the bank a very comfortable liquidity level both in local and foreign currency.

The capital adequacy ratio as of 30st of September reached 21.97% far above the regulatory minimum of 10%.

| ths. UAH | 30.09.2017 | Q3 2017 |

| Interest income | 2 363 057 | 755 918 |

| Interest expense | (474 888) | (128 894) |

| Commission income | 1 425 465 | 492 423 |

| Commission expense | (298 228) | (110 422) |

| G/L FX | 250 369 | 66 725 |

| Net income (loss) from other business | (114 663) | (14 797) |

| Net banking income | 3 151 112 | 1 060 953 |

| Operating expenses | (1 655 693) | (566 291) |

| Gross operating income | 1 495 419 | 494 662 |

| Cost of risk | (461 192) | (129 445) |

| Pre-tax net profit/(loss) for the year | 1 066 370 | 383 406 |

| Corporate income tax | (210 075) | (93 795) |

| Net profit/(loss) for the year | 856 295 | 289 611 |