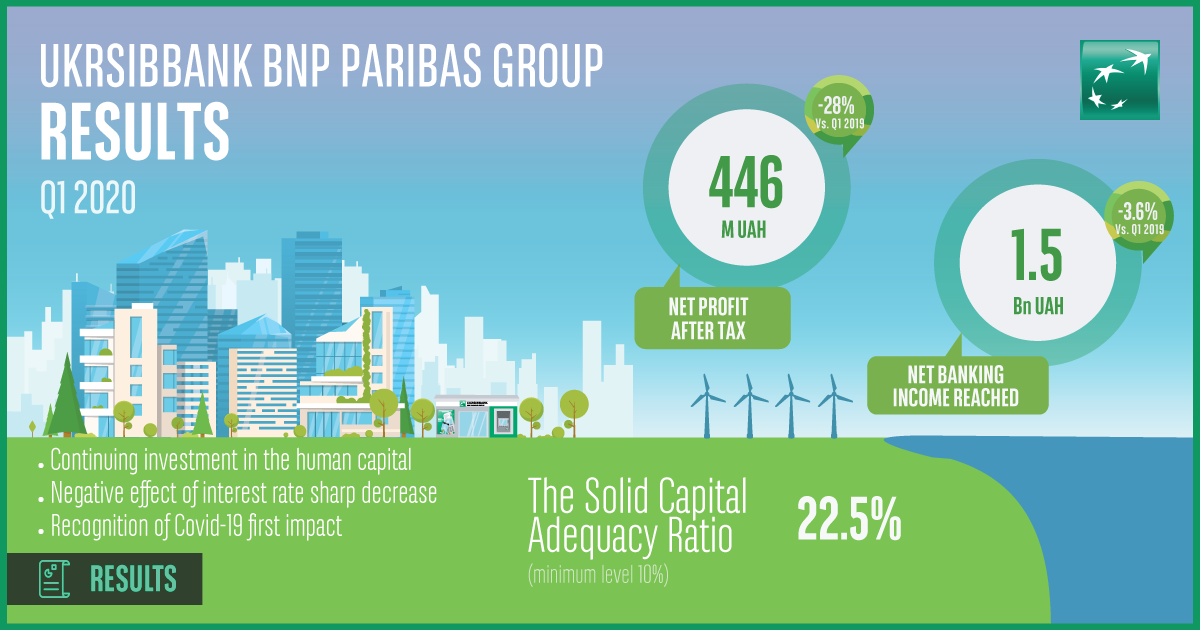

UKRSIBBANK posted in Q1 2020 a net profit after tax of UAH 446 M

In 1Q’20 the UKRSIBBANK has posted the NPAT (net profit after tax) of UAH 446M (-28% YoY). Net banking income reached 1.5 Bn UAH (-3,6% YoY) negatively impacted by the sharp decrease of the key central bank rate from 18% in Q1 2019 to 10% in Q1, partially compensated by commercial performances of the Corporate and Retail business lines.

The operational expenses reached 0,9Bn UAH (+17% YoY). The growth indicate the bank transformation commitments by investing in Human and IT capital despite the outbreak of Covid-19 and strong reduction of interest rates.

Cost of risk amounted to -58M UAH (156%). The growth is driven mainly by negative base effect (low base in the 1Q’19).

The COVID-19 impacts on 1Q’20 were limited due to the fact that the pandemic outbreak impact on Ukraine started at the break of 1st and 2nd quarter.

The Bank has decided not to distribute dividends for 2019 and use the accumulated profits to further strengthen its capital base. The Solid Capital Adequacy Ratio of 22,5% is far above the minimum level of 10%, leaving room for further responsible growth.