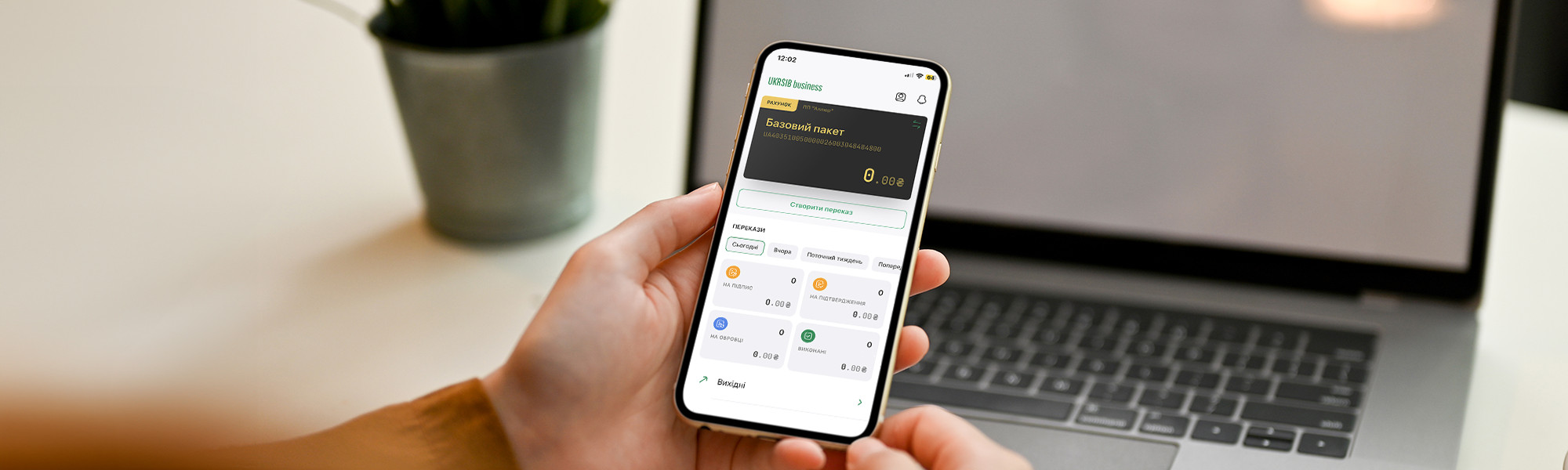

Internet banking system UKRSIB business

UKRSIB business is a remote account service system enabling the accounts and transactions management at any time and from any device.

In a mobile application:

Review the account balances in hryvnia and foreign currency.

Generate account statements and turnovers on accounts (both in hryvnia and foreign currency) enabling thereof export to file (PDF, RTF, XLS, CSV).

Switch between the companies and manage a list of companies’ accounts, which transactions are accessible, including key data, such as the title and number of the account, thereof balance and currency.

Set up Push-notifications for convenient operation in the application.

Create, edit, copy, sign and delete a request for a currency sale.

Change the application language and the interface background to light/dark; select the display of data by user and company.

More opportunities with UKRSIB business application

Fund-transfers

Generate fund-transfer individually of by template. Make fund-transfer in-between your own accounts. Manage fund-transfers, edit, copy, and delete.

Signing the payments

Sign payments; carry out a package signing of several documents concurrently.

Additional filters

Filter documents by periods, and by incoming/outgoing payments.

Authorization

Undergo the authorization procedure by means of login/password, Face ID/Touch ID.

To use the application, pass the registration procedure on the UKRSIB business web-version.

Extended capability of the UKRSIB business web-version

To use the application, pass the registration procedure on the UKRSIB business web-version.

Payments

• generating the payment instructions in the national and foreign currencies;

• revocation of the national-currency payments;

• generating of intra-bank payment instruction in the foreign currency;

• generating the requests for buying, selling, and converting a foreign currency.Payroll card programs

• Payment of wages to employees;

• Opening accounts for newly hired employees;

• Disconnecting the employees who retired from servicing.Corporate cards

• changing the limits for transactions on cards, review of current limits;

• generating the Statements on accounts and cards.Deposits

• deposits replenishment;

• reviewing the list of opened and closed deposits and terms and conditions thereunder;

• reviewing the reports within the scope of deposit lines and the term deposits.Loans

• repayment of loan indebtedness;

• generating requests for credit tranches obtaining.Controlling the funds for additional services

System User Manual• receiving the current balance related information;

• generating the Statements of accounts;

• reviewing the turnover on accounts;

• receiving the information on the NBU set foreign exchange rates;

• review of the updated statuses of documents submitted to the Bank;

• an opportunity to use reference guides for the enterprise employees the Bank branch codes (MFO), SWIFT-codes, and the other reference guides;

• setting the notification in the form of SMS-messages, email messages on a cash-flow under accounts, logging-in the system, and receiving notifications from the Bank.

Manuals

the «UKRSIB business» System

the «UKRSIB business» Application

Video manuals (UA version)

Files for download

Plug-ins for a PC

Browser extensions

Frequently asked questions:

How to extend the validity of the Qualified Electronic Signature (QES) for operation in the UKRSIB Business Internet-banking?

To extend the QES validity and for successful and secure signing the payment-related documents through the Internet platform it is required to:

- Enter the UKRSIB business Internet-banking application.

- Select the option “Settings”.

- Go to “My Profile”.

- Select the tab “Keys”.

- Select the image (to the right upper side of the screen) “Three dots”.

- Select the Section “Extend the key”.

- Enter old password and create a new one.

- Confirm your action by pressing “Extend validity”.

A video guide on extending the qualified electronic signature certificate is available by link (UA version).

Did not find the answer to your question?

You may ask specialists or apply to the nearest UKRSIBBANK Branch.