Trade finance

Trade finance

Globalization, unstable markets and competitive environment call for responsiveness and flexibility. To keep up with the new and unstable environment, BNP Paribas launched an unmatched network of Trade Finance Centers, which is unprecedented in banking.

Trade Finance Centers are aimed to offer our clients trade financing opportunities, which they need to feel confident and succeed in business and offer the financing for their business, both in Ukraine and in foreign markets.

Using the unique experience and professional skills of UKRSIBBANK experts, including with the participation of a worldwide network of Global Trade Services BNP Paribas.

UKRSIBBANK Trade Finance Center is part of BNP Paribas Trade Finance Centers network featuring over 90 centers worldwide.

This allows our customers to enjoy certain perks within BNP Paribas, which fosters their global commercial activity.

UKRSIBBANK Trade Finance center can:

Help to find trade partners in over 50 countries worldwide; advise you on legal specifics of a certain country, as well as on stability and business reputation of contractors;

Provide financing within BNP Paribas, which means our clients will spend less compared to other conventional credit instruments;

Give professional advice on how to choose and apply the most efficient schemes to pay to contractors from domestic and foreign markets in line with specific customers’ needs at any stage of commercial agreement;

Ensure that its own letters of credit (on request of exporter) are accepted by BNP Paribas banks worldwide, as well as by other global banks, at competitive prices;

Provide bank guarantees and issue BNP Paribas guarantees in many countries around the world. The Center also cooperates tightly with other top-flight banks both on developed and emerging markets;

Confirm export letters of credit; act as a designated bank. The Center could also advise guarantees and letters of credit issued by other banks to non-UKRSIBBANK clients;

Provide guarantees for residents of Ukraine which are secured by counter-guarantees at other Ukrainian and foreign banks.

Export letter of credit

If you export goods and/or services and want to get a guaranteed payment upon delivery, our Export letter of credit service can be of good use to you. As part of this service the Bank guarantees you receive your payment for delivery of goods and/or services if you provide documents, which fully meet the requirements set out in the letter of credit.

Key benefits of Export documentary letters of credit:

Security matching your business relations (solid and absolute obligation of the bank under irrevocable export documentary letter of credit or double obligation under confirmed export documentary letter of credit).

Import letter of credit

If you import goods and/or services you will undoubtedly want to make sure the goods/services are actually dispatched in line with the contract before you pay for such goods and services. By choosing our Import letter of credit service you may be sure the payment to your supplier will be made only upon dispatch which will be confirmed with appropriate documents to be provided to the bank by your contractor.

Key benefits of Import documentary letters of credits:

Guaranteed goods and/or services dispatch (when concluding a contract, you and your contractor can outline documents to be provided for payment of documentary letter of credit, which helps avoid risks to pay for undispatched goods and/or services);

The relationships between you and your supplier may benefit significantly if he feels confident about receipt of payment, which is especially relevant when new markets open or you come into business with new partners.

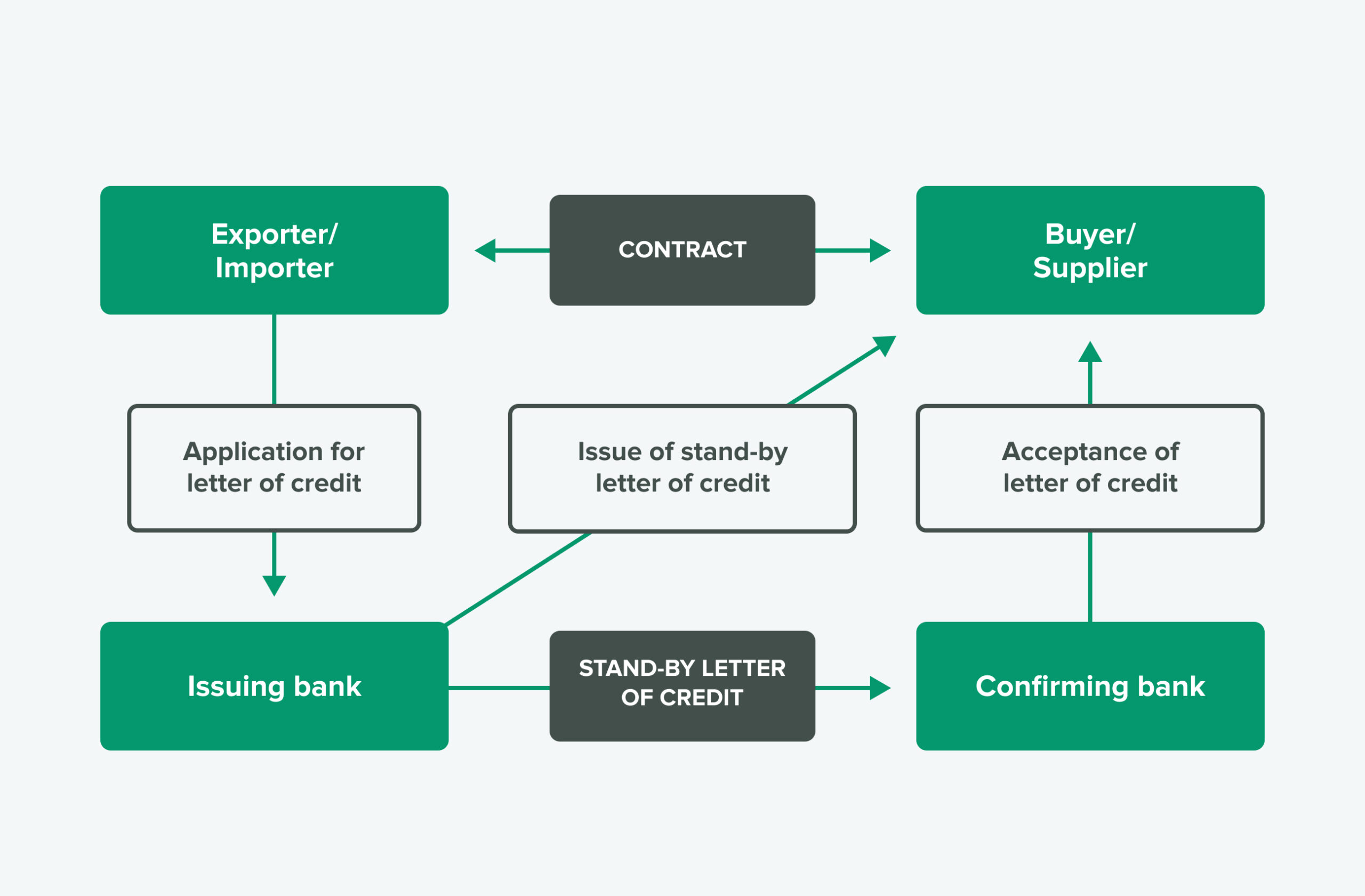

Stand-by letter of credit

Stand-by letter of credit is in fact a bank guarantee to be paid for against provision of previously specified documents: payment claims and minimum package of documents used to make payments to the Beneficiary if the Applicant fails to discharge his obligations under the Contract.

Key benefits of stand-by letter of credit:

safeguard against non-fulfillment of your client’s obligations towards you (if you are an exporter, stand-by letter of credit guarantees payment under your commercial agreement; if you are an importer – letter of credit ensures delivery of goods or services in line with the contract);

Globally-renowned financial instrument.

Opportunity to adjourn your payments, which will put you ahead of your competitors in increasing your supplies and promoting your goods (services) to new markets.

Backup letter of credit diagram

Bank guarantees

Being a buyer or seller, you definitely want to make your external or internal economic operations mostly safe and flexible.

UKRSIBBANK offers bank guarantees — irrevocable obligations of the bank to compensate a certain sum to the Beneficiary if a Principal (your contractor) defaults.

Key benefits of Bank guarantees:

Secured obligations: the bank additionally and independently guarantees that you or your contarctor will definitely discharge your obligations under the contract;

Proof of your high reputation and business reliability (guarantees opened on your behalf by UKRSIBBANK, or by other top-class bank institutions against countergarantees of UKRSIBBANK, testify to solvency, reliability and high business repute of your company).

The most common guarantees issued by UKRSIBBANK or other top-class bank institutions include:

Tender guarantees;

Payment guarantees;

Advance payment return guarantees;

Performance guarantees;

Credit repayment guarantees.

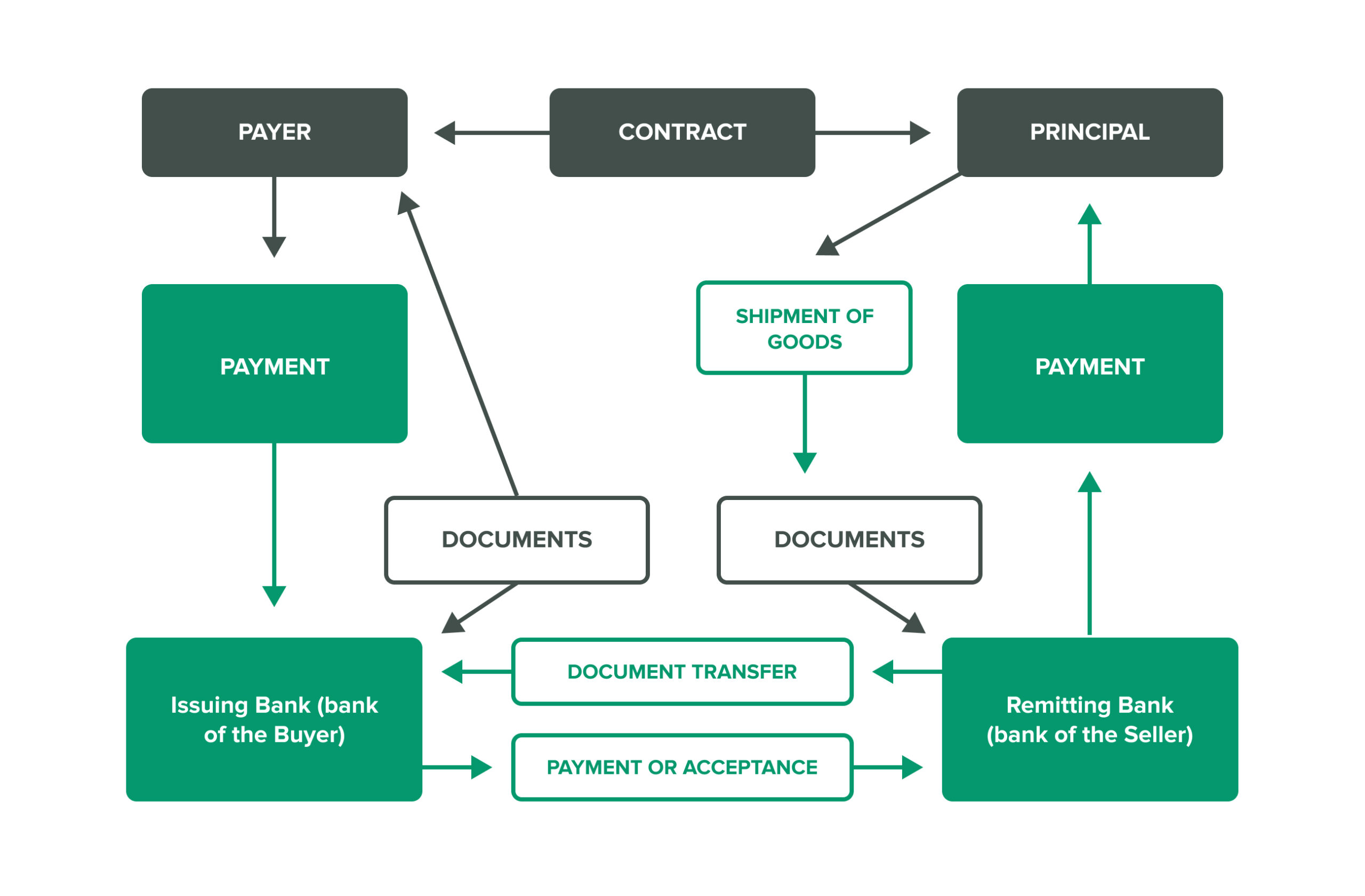

Documentary collection

If you have trust relationships with your foreign contractor, you may try Documentary collection, which is one of the most easy-to-use and cheapest payment methods. In this case, the Bank will serve as an intermediary for the Seller to pass the documents confirming dispatch of goods to the Buyer only after receipt of a corresponding payment or against acceptance of promissory note or on other conditions set out in the collection order.

Key benefits of documentary collection:

Simple and reliable procedure (for a seller, documentary collection gives confidence that the buyer will receive goods after payment or acceptance; for a buyer, documentary collection guarantees the goods will be paid for only upon their dispatch under the contract);

Another benefit for a seller is that payments shall be made only against documents, which confirm delivery of goods under the contract, rather than come as advance payments.