UKRSIBBANK IFRS results 2017 YoY

UKRSIBBANK BNP Paribas Group posted in 2017 a net result after tax of UAH 1 467 M.

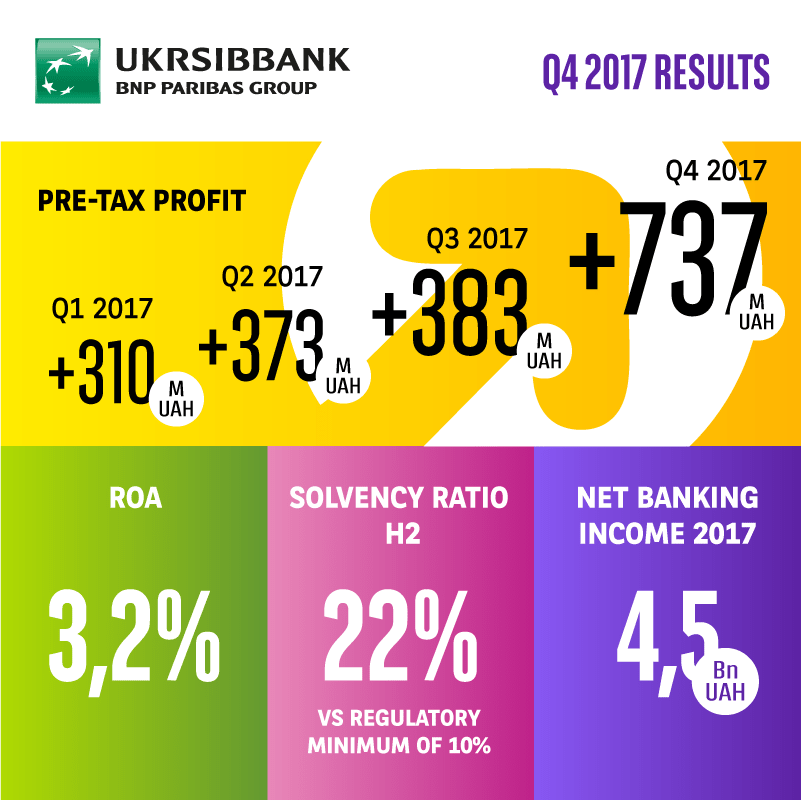

UKRSIBBANK has posted a record quarterly result of UAH 611 M in Q4-17, bringing the cumulative yearly net result after tax to UAH 1 467 M (vs UAH -994 M loss for 2016). These strong results reflect the efficiency of the bank’s business model in the stabilized Ukrainian environment.

The Bank’s performing loan book showed a robust growth of 13% YoY and reached UAH 21.5 Bn, while the clean-up of its old legacy portfolio continued, a.o. with the sale of a few large corporate files. The lending strategy focusing on multinational companies and personal finance customers remains unchanged. In line with BNP Paribas social responsibility charter, UKRSIBBANK exited progressively during 2017 from tobacco industry and refocused on other areas of the Ukrainian economy, a.o. energy saving financing.

The individual FX mortgage loan portfolio continued to shrink thanks to the various initiatives of conversion into local currency, performed at preferential conditions for the customers. These successful campaigns launched mid 2016 enabled the bank to reduce the remaining risks related to this legacy portfolio (-75% in 2 years), hence the cost of risk dropped significantly in 2017.

Customer deposits, around UAH 36 Bn, are overall stable YoY, providing to the Bank a very comfortable liquidity level, both in local and foreign currency. The solid liquidity buffers of UAH 4.9 B in LCY and UAH 5.5 B in FCY show how cautiously the Bank manages the liquidity and protects its customer’s interests.

During 2017, the bank continued to invest in its branch network and in digitization in order to better meet the needs of its target customer segments SME & Premium. The number of business centers and premium branches has increased by 35% to 128 while the total number of outlets in the country went down to 299. The staff employed by UKRSIBBANK remained stable around 5.200 people on average.

“Customer needs are at the heart of our strategy.” explains Philippe Dumel, Chief Executive Officer. “In September, we have successfully launched our new internet & mobile platform for individuals. We will continuously improve customer experience and add new functionalities. Personally, I’m looking forward to the release specifically dedicated to SMEs and large corporate customers foreseen a bit later this year.”

Thanks to a well balanced strategy and to the diversification of its sources of revenues, the Bank has offset the negative impacts of the drop in market interest rates and the narrowing of FX spreads in the normalizing Ukrainian environment. At the end of December 2017, the Net Banking Income reached UAH 4.5 Bn (-1.6% YoY excluding exceptional items). Year-on-year, net interest income decreased by 5% while net commissions & fees showed a growth of 17%. Operating expenses have increased by 21%, reflecting the high inflation in 2017 (14.4% on average) and the tensions on the labor market pushing salaries up. Together with the cleaning of the legacy portfolio and the development of new sound loan portfolio, the cost of risk decreased to UAH 316 M i.e. 1,5% of the total loan portfolio.

The net income after tax for 2017 reaches UAH 1 467 M.

The capital adequacy ratio as of end of December reaches 22.2%, far above the regulatory minimum of 10%.