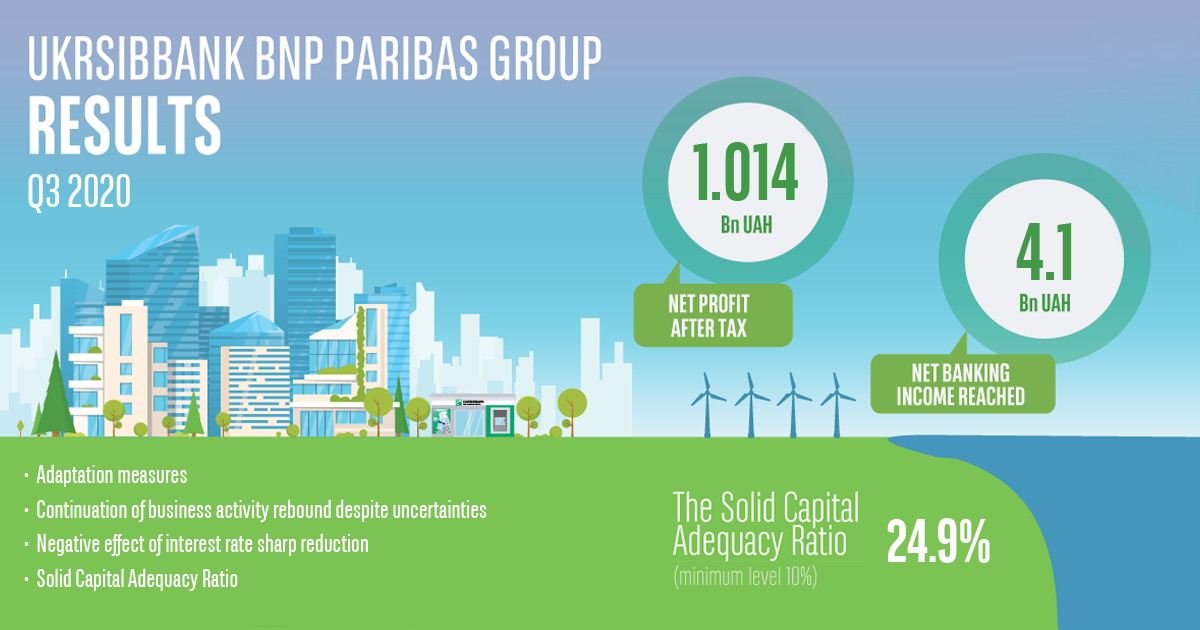

In 3Q’20 the UKRSIBBANK has posted NPAT (net profit after tax) of UAH 1 014M

A quarter impacted by the rebound of the business activity after the spring lockdown and the result of the adaptation measures (NPAT +52% vs 2Q20).

Net Banking Income reached 4,1 Bn UAH, in cumulative, negatively impacted by the interest rates cuts over the year from 18% early 2019 to 6% in Q3 2020 and the consequence of the pandemic on business activity in the 2Q’20.

The operational expenses reached -2,7Bn. The bank continues its transformation journey, committed to invest in Human and IT capital as well as the protection customers and employees.

Cost of risk is cautiously monitored and amounted -0,2Bn UAH at the end of the quarter mainly impacted by Covid-19 in the second quarter.

Solid Capital Adequacy Ratio of 24.9%, far above the minimum level of 10%, leaving room for further responsible growth.

We continue to adapt to our environment and organize our activities to meet our clients needs while protecting our employees and stay focus on delivering resilient results. We kept, this quarter, our leader position as bank likely to be recommended by our clients illustrating our commitment towards our customers.